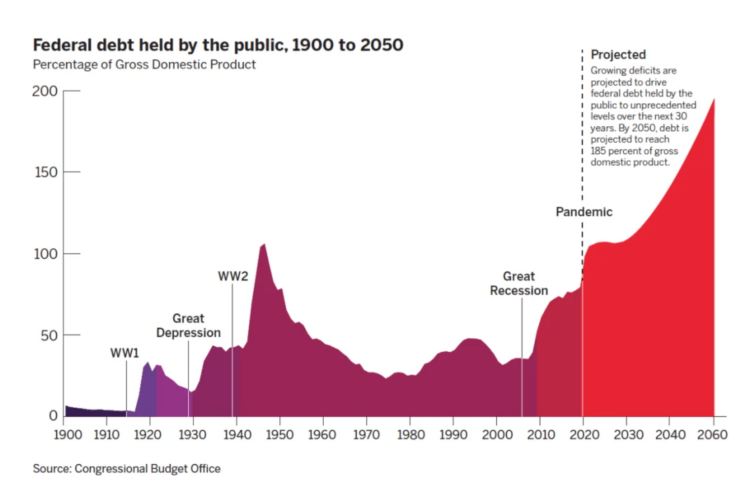

March 10. By Mike Walden. [Commentary] The national debt has been an issue in the U.S. for decades. But concern about the debt has peaked for two reasons. The first is the debt’s size, today totaling $36 trillion. As a percentage of the economy, the debt is at 120 percent. The only other times the debt was above 100 percent of the economy were during COVID and in World War II.

The second reason the national debt is in the headlines is the effort by the federal Department of Government Efficiency (DOGE) to deal with the debt by reducing federal spending.

Yet there are numerous questions about efforts to curtail the debt that sometimes make the issue confusing. The goal of today’s column is to clear up this confusion, allowing you to better understand both the concerns about the debt and the options for addressing those concerns. Then you can decide what to do.

Debt vs. deficit

A starting point is basic definitions about the debt. Often the words “debt” and “deficit” are used interchangeably. They are different. Debt is the total amount the federal government owes, like the balance on a credit card. Deficit is the annual amount added to the debt, comparable to the annual spending added to a credit card.

Also, like private debt, the national debt has two components. One is the principal, which is the total amount borrowed. Today the principal is $36 trillion. The second is the periodic interest payment made to those who finance the national debt. Those interest payments are approaching $1 trillion annually and are now the fourth-largest category of federal spending.

Both domestic and foreign investors purchase U.S. Treasury securities to finance the national debt. Why do they do this? It’s because owning part of the national debt is considered a relatively safe investment. The U.S. government has tremendous national assets, and it has never missed an interest payment to investors.

How to address debt

There are two steps to addressing the large national debt. The first is to stop adding to the debt. Currently the annual federal deficit is almost $2 trillion. At this pace, the national debt is increasing by $2 trillion each year. DOGE’s stated goal is to reduce that amount to $1 trillion. The debt will still be rising, but by a lower amount.

But there’s another complicating element: proposals to take some of the deficit reduction and return it to taxpayers. For example, if DOGE is successful in reducing the annual deficit by $1 trillion, an idea has been proposed to take 20 percent of this amount — $200 billion — and return it to taxpayers in the form of “DOGE checks.”

This would mean the deficit reduction would be $800 billion, not $1 trillion. It also means the $200 billion in checks would be borrowed.

What are the ways to reduce the debt? One simple way is simply to not borrow more, that is, leave the $36 trillion but add no more to it.This would mean having a balanced budget each year, with no borrowing for a deficit. You might say, “What? That’s not reducing the debt, it’s simply keeping it the same.”

What’s $36 trillion today vs. a decade from now?

Actually, it is reducing the debt in two ways. First, because dollars lose value over time, $36 trillion in the future is not the same as $36 trillion today. Dollars lose value over time just by having a typical modest annual inflation of 1 percent to 3 percent. For example, with an annual inflation rate of 2 percent for the next 10 years, the purchasing power of today’s $36 trillion debt would be 22 percent less in a decade.

Second, as the economy expands, the relative size of $36 trillion would decline. For example, if the economy grew at the same rate as last year for each year of the next decade, the relative size of the national debt to the economy would decline from 120 percent to 77 percent.

Regardless, it takes discipline

But not borrowing would require discipline. Some have said our federal elected officials need a direct incentive to eliminate borrowing. One idea has been proposed to do just this: require that any spending above current tax revenues would automatically trigger a tax increase to generate more revenues so borrowing is not needed. In essence, all spending would be paid for by taxes. Because many, perhaps most, voters don’t like tax increases, the incentive of a tax trigger would be a strong motivation for a balanced budget.

Another idea was proposed 60 years ago when deficits first became a big issue. The proposal was to model the federal budget after most states’ budgets, and indeed after business budgets. The proposal is to divide federal spending into two parts: an operating budget and a capital budget. The operating budget is for expenses that keep the government operating today, and funding the operating budget would be from current tax revenues only. The capital budget would be for investments that impact many future years, like road construction, military equipment, and research and development. Since the benefits from capital spending impact future taxpayers, capital spending could be funded by borrowing, meaning the funding is paid over numerous years.

The country has struggled with deficits and debt for several decades, with no solution in sight. We’ll see what will come from current efforts to tame federal borrowing. Ironically, I remember when the opposite was an issue. During the 1990s, the federal budget ran a surplus for several years, and there were projections that this would continue for decades. The worry was what this would do to financial markets with no new federal Treasury securities being issued.

Can we reach this “pleasant problem” again? You decide.

—Mike Walden is a Reynolds Distinguished Professor Emeritus at North Carolina State University

So Doge or anyone else for that matter should not try to cut waste and fraud.

How about suggest some accountability in the government stop spending money haphazardly and on special interests. This article sounds more like propaganda rather than a solution.

Posted by Rick | March 12, 2025, 9:29 am