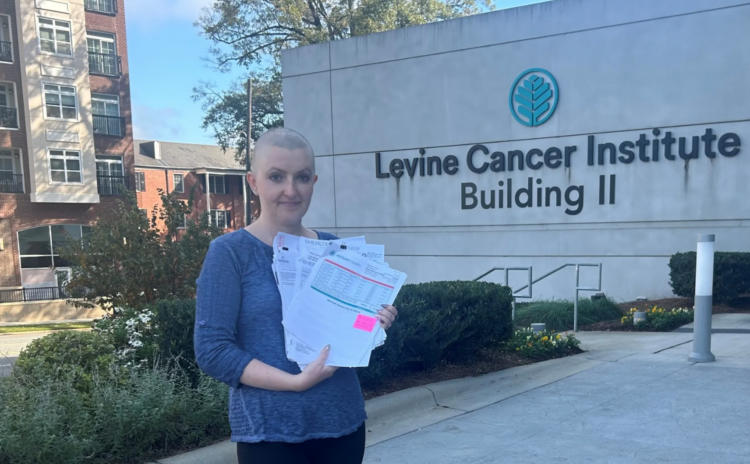

Mary Katherine Snow of Cornelius. Photo: Michelle Crouch/NCHN

One cancer patient’s fight to correct errors on her medical bills exemplifies frustrations shared by many.

Nov. 26. [Analysis] By Michelle Crouch/North Carolina Health News co-published with The Charlotte Ledger. When Mary Katherine Snow of Cornelius was diagnosed with leukemia in 2017, she was prepared to fight for her life.

But she didn’t expect that in addition to fighting cancer, she would also have to fight a cascade of medical billing errors that tanked her credit score, required hours of back-and-forth with her hospital and her health insurer, and piled on stress at a time when she could least afford it.

“I’ve spent so many hours trying to fix these mistakes,” said Snow, now 32. “It’s like a second job. I’ll be talking to the hospital, then insurance, then the debt collectors, and then back to the hospital. … It’s too much when I’m just trying to get through each day.”

Unfortunately, error-ridden bills are a reality for many patients; national studies show that more than half of all medical bills have some kind of mistake.

Experts blame America’s overly complex medical billing system, with thousands of codes and little price transparency, along with poor communication between insurers and providers. The system puts the burden on patients to untangle errors, advocate for the care they need and navigate conflicting information.

In a 2024 survey of North Carolina residents, 42 percent said they’ve received a medical or dental bill that contained a mistake.

Widespread frustration

Doug Smith of Charlotte said he also got caught up in a medical billing snafu. In late 2023, he received a surprise $472 bill for blood work from Atrium Health Pineville, as well as a letter from United Healthcare denying the claim. The problem? Smith had never been to Atrium Health Pineville, and he was no longer insured by United Healthcare.

Fearing identity theft, Smith got on the phone with Atrium billing. He said he talked to several agents who promised to get back to him. They never did.

It wasn’t until he filed a complaint with the North Carolina Attorney General that an Atrium executive reached out. The executive explained that a Novant doctor who had ordered blood work for Smith had offices at Novant and at Atrium—and that led to the billing mix-up.

“The thing that bothered me the most is everyone stonewalled me,” Smith said. “It was incredibly frustrating.”

In a Reddit forum dedicated to the Charlotte area, posts about medical billing problems often spark a flood of responses from fed-up patients. They share stories about repeated calls and back-and-forth billing, bungled paperwork, customer service reps who seem to have little training or empathy, and balances that — even though they were still under review — got sent to collections.

Many echo the frustration of the Redditor #Wulfkat. He shared this story about his bill from another hospital getting sent to collections after an urgent care visit:

“The original bill apparently had the wrong account number so every time I tried to pay, the website would kick me out. It took 13 emails and 4 irate phone calls to fix their system so I could pay the damn bill. That was 4 months ago and I am STILL getting mail from both Novant and the collection agency, even after providing the —– confirmation number. I am in nuclear levels of rage over this.”

For patients with a prolonged illness, billing problems can snowball, said Lucy Culp, executive director of state government affairs for the Leukemia & Lymphoma Society.

“You’ve got to become an expert not just on your cancer, but on your insurance benefit design and on hospital billing,” Culp said. “It keeps people from being able to focus on getting well.”

For Snow, problems first arose in 2020 when she received a staggering $30,000 in bills for a round of cancer treatment at Atrium Health.

It turned out Snow’s care had been mistakenly billed as out-of-network. Snow said it took months — and dozens of back-and-forth calls and messages with Atrium and her insurer — to resolve it.

In 2022, Snow faced another round of billing problems related to a November 2021 bone marrow transplant. When the first bill arrived — six months after the procedure — Snow said she realized right away that the hospital either hadn’t filed with her insurance or had the wrong insurance information. Over the following months, more bills arrived, all with the same error.

Each time, Snow said, she contacted Atrium, explained the situation and shared her insurance information. Each time, she said, a billing representative promised to investigate and follow up in 30 days. But according to Snow, none ever did. She started recording the calls and keeping meticulous notes about who she talked to and what they said.

Then one day, she got a call from a debt collector — the first of many. With no notice, Snow said, her debt had been sent to a collection agency, even though she was still disputing it.

When Snow told the collectors her insurance should have covered the bill, they said to take that up with Atrium. When she called Atrium, they said she had to submit the bills herself to her health insurance company. But by then, her health insurer said it was too late — she had missed their deadline to submit charges.

“It just left me feeling helpless and completely overwhelmed,” she said. “When you can’t eat and when you’re really suffering through cancer and the treatments, and then you get these notices in the mail and awful phone calls. … I would not wish this on anyone.”

Atrium responds

After reviewing some of the most outrageous bills Snow received, along with statements, screenshots of chats between her and billing representatives and phone recordings, the Ledger/NC Health News asked Atrium Health for comment.

Atrium declined to answer specific questions about Snow’s case, citing patient confidentiality, even though Snow offered to sign a release of her information. In response to general questions about patient difficulties in resolving billing errors, the hospital sent the following statement:

As a nationally recognized leader in health care, we often see patients with complex illnesses. As you can imagine, this can result in complex billing matters that sometimes take an extended amount of time to resolve. We appreciate the opportunity to help our patients, answering any questions they may have. When billing issues or concerns are brought to our attention, we work with our patients to address them, including advocating on their behalf to resolve mistakes, whether made by us, their insurance company or any other responsible party.

With more than 70,000 billing codes representing various treatments and procedures, there’s plenty of room for mistakes, said Charles Silver, who holds the Roy W. and Eugenia C. McDonald Endowed Chair of Civil Procedure at the University of Texas at Austin School of Law. He is co-author of Overcharged: Why Americans Pay Too Much for Health Care.

“They make billing absurdly complicated, and providers make extra money if they overbill,” Silver said.

Further complicating matters is that health insurance companies are generally responsible for reviewing claims, but they “don’t know what services are delivered, so they are in the dark,” Silver said. “And from the patient’s perspective, figuring it all out is impossible because they don’t know the codes.”

Patients often find themselves juggling administrative tasks, trying to reconcile bills from different providers and insurers, or fighting insurance denials based on incorrect information.

The National Patient Advocate Foundation, a nonprofit that helps patients resolve billing problems, said its professional case managers make an average of 32 phone calls to resolve one case.

“Even if you catch an easy mistake, it’s an arduous process,” said Caitlin Donovan, senior director of the foundation. “It can be difficult to get the right person on the phone.”

And when you find the right person … you may never speak to them again. Many health care systems don’t allow customer service agents to give out their direct contact information, so you have to talk to someone different every time you call.

A 140-point plunge in her credit score

Snow, who is now participating in a trial for a new leukemia treatment, said she is still untangling bills from her 2020 treatment and 2021 bone marrow transplant at Atrium.

In October 2023, Snow got an alert from her bank that her credit score had plummeted 140 points. At first, she thought her identity had been stolen. When she investigated, she learned Atrium had reported her medical debt to three collection agencies.

(Atrium Health no longer reports medical debt to credit agencies, and in September 2024 it cancelled thousands of past judgments against patients for unpaid bills.)

After posting a complaint on Google Reviews and emailing an angry letter to Atrium, Snow received a call in December 2023 from a customer service representative named Marcia who promised to help figure things out.

Snow said she felt hopeful because Marcia called her three times in early 2024 with follow-up questions. Then, without warning, Marcia went silent, not responding to Snow’s calls or messages for months.

In July, almost six months after their last contact, Marcia resurfaced and told Snow she had been out on medical leave. Together, Marcia and Snow worked through Snow’s bills for the transplant. By August, Snow thought that everything was resolved.

But in late October 2024, Marcia reached out to Snow with bad news: She said Snow still owed the hospital $961.

Stunned, Snow asked for the date of service. Marcia said it was a charge from May 1, 2020 — the very start of Snow’s billing saga four years ago. She then offered a 20 percent discount if Snow paid immediately.

Snow was speechless, her frustration turning to anger as she recalled contesting this very charge four years earlier.

“What started out as annoyance at their incompetence has turned into infuriation and rage,” Snow said. “I love my doctors, but their billing system is horrible. It lights a fire in my heart — I’m not going to stop fighting this because it’s unjust.”

But her fight might finally be over. Less than a week after The Charlotte Ledger/NC Health News asked Atrium about Snow’s billing problems, she received a call from an Atrium assistant vice president.

He said that instead of a $961 bill, her balance was zero.

This article is part of a partnership between The Charlotte Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. North Carolina Health News is an independent, non-partisan, not-for-profit, statewide news organization dedicated to covering all things health care in North Carolina. Visit NCHN at northcarolinahealthnews.org.

The NC health system is loaded with opportunities for scammers.

Posted by Karen Asche | November 26, 2024, 2:57 pm