Jackie Huffman and Ken Joyner answer questions at the Reval Newsmakers Breakfast

By Debbie Griffin. Valuations of some Mecklenburg County commercial properties have soared—some considerably more than the average of 77 percent for commercial property, which includes apartments. The median increase for residential properties is 43 percent.

Some new valuations are at or near doubling from prior valuations:

• Publix at Magnolia Plaza: $22.3 million from $11.97 million

• Bexley Apartments on Sterling Bay: $40.2 million from $21 million

• Foamex industrial complex: $11 million from $7.33 million

At a Newsmakers Breakfast at The Peninsula Club with Mecklenburg County Tax Assessor Ken Joyner and Huntersville Assistant Town Manager Jackie Huffman, property owners and elected officials expressed concern about how the valuation increases would affect small business.

“Somebody’s going to get kicked in the shin,” said Charles Knox, founder of The Knox Group, a commercial real estate brokerage in Huntersville.

The valuation of the Oak Street Mill in Cornelius rose 483 percent in the 2019 reval. The property, a 1920s mill, increased in value from $893,400 in 2011 to $4.3 million.

Increases in property taxes are routinely passed on to tenants in triple net leases, which allow for adjustments in expenses like landscaping, building maintenance and taxes.

“All the costs to maintain the building are passed through to the tenants,” Knox said, because they’re the ones “benefiting from the property.”

Joyner said valuations were based on recent sales as well as replacement cost and the revenue commercial properties generate. “We simply look at the facts and try to get the assessments right. When it comes to commercial values, we look at three parameters: cost, income and sales. Clearly there has been a significant increase since the last valuation,” he said, explaining that he hopes to “enhance the tools” and amount of detail available for commercial properties for the next reval.

Only after local tax rates are set can landlords really get down to the task of calculating exactly what the new values will mean in terms of dollars paid. Knox said it is after that point when property owners inform the tenants about increases.

Huffman addressed the concept of a “revenue neutral” tax rate, a state-required figure which all municipalities must publish during their budget review in May and June.

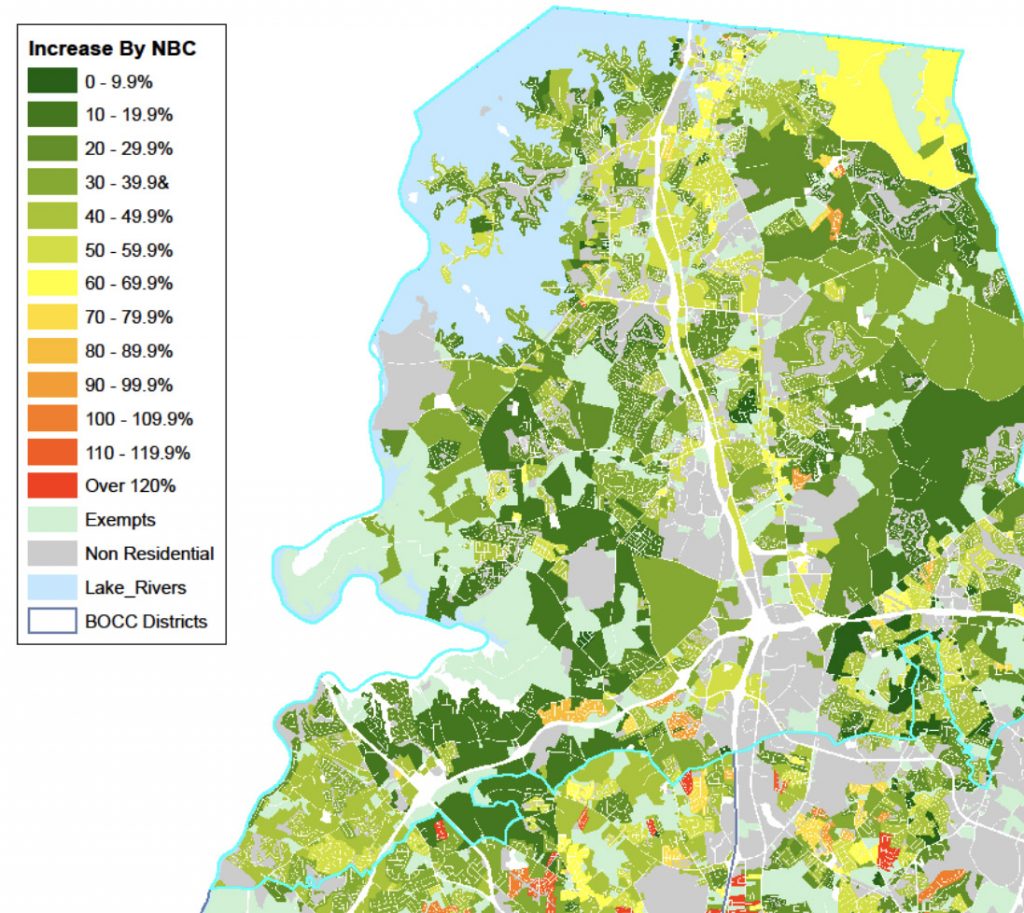

North Mecklenburg heat map showing the percentage of increase in property values at the neighborhood level

“What I think most people don’t understand is revenue neutral does not mean each taxpayer pays the same amount of tax each year; revenue neutral means the town’s property-tax collections remained flat comparing taxes the year before the revaluation and the year after the revaluation,” Huffman said. “Revenue neutral is really a tool to be used from the town’s perspective, not individual taxpayers.”

The towns are beginning to craft their budgets now; boards must approve their final budgets in June before they go into effect July 1. It is then the when the complete taxation picture comes into focus.

Property owners can appeal the newly assessed value. Commercial brokers like Knox said the revaluation process this time around was much improved over the 2011 process. Attorney Robert McIntosh, founder of The McIntosh Law Firm, said property owners should consider appealing valuations that are 40 percent or more above the previous valuation.

“There is no way to determine how the individual taxpayer will be affected until final values are set and the County determines the final rate,” McIntosh said. McIntosh has launched a practice, Carolina Revaluation Services, focused on the revals with former NC Sen. Jeff Tarte and Lawrence Shaheen, an attorney as well as Tarte’s long-time campaign manager.

“The safest bet is to challenge values, both commercial and residential, where the increase is more than 40 percent. Those values are most likely to see a tax increase, regardless of the rate,” he said.

Joyner said property owners should have a value in mind before meeting with the Board of Equalization and Review, which can adjust the value—or not—based on evidence presented.

Appeals must be filed by May 20.

Cornelius Town Commissioner Kurt Naas said using a single tax rate for an entire county based on a county-wide reval is the equivalent of a blunt instrument.

“The system we have in NC means the tax burden shifts to appreciating neighborhoods. It’s unfortunate, but that is our current reality,” Naas said.

Soaring land values in some neighborhoods can drive long-time residents out of communities. Parts of Davidson near the center of town and in Cornelius’ Smithville neighborhood, a historically black community just west of I-77, have had particularly strong increases in property values.

Naas says that can present problem.

Old houses are being torn down to make way for much larger homes, ultimately displacing entire communities.

“The issue with our system is that people in an appreciating neighborhood like Smithville can literally be taxed out of their homes. That’s just wrong,” Naas said.

“The NC homestead exemption should be expanded to include a limit on tax increases for multi-generational and long-term homeowners,” Naas said.

This will all play out as budget discussion get under way.

Valuation appeal process starts informally

1. Informal appeals is still under way

2. Mecklenburg Board of Equalization & Review, which is formal/

quasi-judicial, ends May 20

3. NC property tax commission (the taxpayer can appeal to this

level, process starts all over)

4. NC Court of Appeals

5. NC Supreme Court

–Source: The McIntosh Law Firm

Discussion

No comments yet.