Sept. 23. Duke Energy Corp. is among the top 10 corporations that paid the least in corporate taxes, according to a WalletHub study.

Duke Energy, with headquarters in Charlotte, ranked ninth in the companies paying the lowest taxes (overall tax rate), paying 5.10 percent.

The overall tax rate that S&P 100 companies pay, around 18 percent, is about two percentage points lower than they paid in 2020, WalletHub found.

S&P 100 companies pay roughly 20 percent lower rates on U.S. taxes than international taxes.

Highest payers

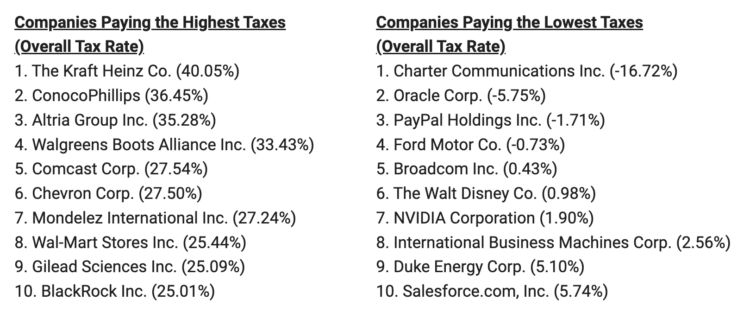

The top three companies paying the highest taxes (overall tax rate) include one with a Cabarrus County connection and are The Kraft Heinz Co. (40.05 percent), ConocoPhillips (36.45 percent) and Altria Group Inc. (35.28 percent).

Philip Morris USA, once a Cabarrus County cigarette manufacturing plant, and a subsidiary of Altria Group Inc., closed its Concord plant in July 2009.

Negative payers

According to WalletHub, four S&P 100 companies—including one with a Mecklenburg connection— are actually paying a negative overall tax rate and are therefore due a discrete net tax benefit: Charter Communications Inc. (-16.72%), Oracle Corp. (-5.75%), PayPal Holdings Inc. (-1.71%), and Ford Motor Co. (-0.73%).

PayPal is the online money transfer service that had planned to open an operations center in Charlotte, but canceled in 2016 citing HB2, North Carolina’s anti-discrimination law.

Lowest payers

Among the remaining companies that owe taxes, Broadcom Inc. (0.43 percent), The Walt Disney Co. (0.98 percent), NVIDIA Corporation (1.90 percent), International Business Machines Corp. (2.56 percent), Duke Energy Corp. (5.10 percent) and Salesforce.com (5.74 percent) pay the lowest rates.

Duke Energy is one of the top five corporations in NC by revenue.

Expert opinion

The U.S. is definitely leaving money on the table with the current corporate tax structure, according to Nyamagaga Gondwe, assistant professor of law at University of Wisconsin Law School.

Nyamagaga Gondwe | Courtesy WalletHub

“Even though corporate distributions are taxed twice—at the corporate level and the shareholder level—the current corporate level tax rate of 21 percent is lower than the average tax rate for married couples earning more than $65,000 (22%) and the average rate for single filers earning $50,000 (22.2 percent) or more,” she said.

Congress changed the top corporate tax rate from 35 percent to a uniform rate of 21 percent in the 2017 Tax Act.

Source: WalletHub

what is the likelihood that Duke is going to pass on that tax to its customers? Does Duke make electricity just for kicks or as a public service/ business? Since

the only reason Duke makes electricity is for its customers, having them pay more tax is only going to have that tax passed on to Dukes customers.

Posted by Nikola Edison | September 23, 2022, 5:23 pm